Contents

What is the full form of UPI?

The UPI Full Form is Unified Payments Interface, this is a way with which you can send money from your bank account at any time, anywhere, to your friend’s account or relatives’ account, and if you need to pay someone Even if you have to, you will be able to give money easily with the help of UPI.

You can make any kind of payment with the help of it, like if you have bought some goods online, then you can pay with UPI or if you have made some purchases by going to the market, you can still use UPI.

Taxi fare, movie ticket money, airline ticket money, mobile recharge and DTH recharge are all types of payments you can make through UPI. And they will transfer money from your bank account to the bank account of the person in front of you very quickly and immediately.

The initiative to start UPI has come from NPCI. NPCI’s full name is National Payments Corporation of India, an organization that currently manages the ATMs of all banks in India and their interbank transactions between them.

For example, if you have an ATM card of Axis bank, then you can withdraw your money by going to the ICICI bank ATM. NPCI takes care of all the transactions going on between these banks.

In the same way, with the help of UPI, you can send money from your one bank account to the account of the front bank.

How does UPI work: UPI Full Form

UPI is based on IMPS i.e. Immediate Payment Service System, which we use when using other net banking apps on mobile.

This service can be used all the time, every day, even on holidays. And UPI also works on this system. But here the question arises that if UPI and all other types of net banking apps work based on the same system, then what is different between them?

UPI is different from all those apps, how? I want to give you an example to tell you this.

UPI Full Form And How to use

To use UPI, you must first install its apps in your Android phone. There are many bank applications that support UPI such as Andhra bank, Bank of Maharashtra, Axis bank, ICICI bank etc.

You have an account in your bank, by going to the Google Play Store or Apple Store in your phone. You have to find and install UPI app of that bank. After installing, sign in it and then create your account by giving details of your bank there.

After that you will get a Virtual ID, on which you generate your ID, that ID can be your Aadhar card number. Or it can be your phone number or that id can be an address like an email id (like raju@sbi) After all this is done, your work is over there.

After your account is created in UPI, you can easily send money and can also take money

Suppose your friend or relative is in dire need of money. And you have to send money to them as soon as possible, so what do you do in the earlier apps. You open that apps and login, then you have to add the person to whom you want to send money.

While adding, a lot of details have to be entered and for that you should know all the banking details. Just like you need to know the account number of that person, then their IFSC code, branch name etc. have to fill this type of details. Which takes a lot of time.

But all these things are not required in UPI, you just have to enter the UPI ID of that person. Which you will talk about next, and by choosing how much money to send, you can easily send money.

Neither the hassle of inserting any bank details nor it takes much time and there is no need to tell this to the front. That his account is in which bank or by which name it is registered in his account. Without knowing all this, with the help of UPI, we can send money quickly and safely.

There is also a limit to send money in UPI and that limit is 1 lakh rupees per transaction and fees for sending money are charged. per transaction 50 paise, this is a very small amount, that is, you will not have to spend too much money to send money. And you will also be able to take advantage of instant money transfer.

List of UPI Supported Banks

- State Bank of India

- Kotak Mahindra Bank

- ICICI Bank

- HDFC

- Andhra Bank

- Axis Bank

- Bank of Maharashtra

- Canara Bank

- Catholic Syrian Bank

- DCB

- Federal Bank

- Karnataka Bank KBL

- Punjab National Bank

- South Indian Bank

- United Bank of India

- UCO Bank

- Union Bank of India

- Vijaya Bank

- OBC

- TJSB

- IDBI Bank

- RBL Bank

- Yes Bank

- IDFC

- Standard Chartered Bank

- Allahabad Bank

- HSBC

- Bank of Baroda

- IndusInd

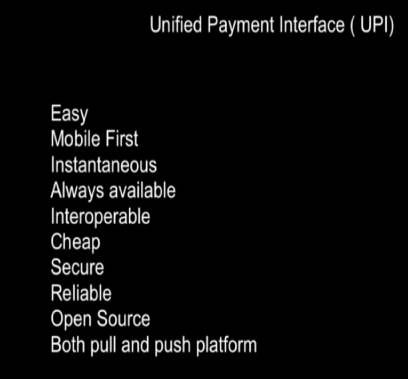

How unique is it: UPI Full Form

- Instant money transfer via mobile device 24 * 7 and 365 days round the clock.

- Single mobile application for accessing various bank accounts.

- Single Click 2 Factor Authentication – Aligns with regulatory guidelines, yet provides a very robust feature of seamless single click payment.

- Pull & Push provides incremental security to the customer’s virtual address in which the customer is not required to enter details such as card number, account number; IFSC etc.

- Sharing the bill with friends.

- The best answer to the hassle of cash on delivery, running to the ATM or giving the exact amount.

- Merchant payment with single application or in-app payment.

- Utility bill payment, over counter payment, barcode (scan and payment) based payment.

- Donation, Collection, Disbursement Scalable.

- Raising complaints directly from the mobile app.

UPI. Participant in

- Payer PSP

- Payee psp

- Remitting bank

- beneficiary bank

- NPCI

- Bank account holder

- The merchants

UPI – benefits of ecosystem participants

Benefits for banks:

- Single click to factor authentication

- Universal application for transactions

- Leveraging existing infrastructure

- Safe, secure and innovative

- Single / unique identifier on payment basis

- Enable Uninterrupted Merchant Transaction

Benefits for end customers:

- Round the clock availability

- Single application for accessing various bank accounts

- Virtual ID usage is more secure, no credential sharing

- Single click authentication

- Raise complaint directly from mobile app

Benefits for traders:

Uninterrupted Fund Raising From Customers – Single Identifier

There is no risk of storing the customer’s virtual address such as in a card

Tap on customers who do not have credit / debit cards

Suitable for E-Com and M-Com transactions

COD storage fixes the problem

Single click 2FA facility to customer – seamless bridge

In-App Payments (IAP)

UPI enabled application registration

Steps for registration:

- The user downloads the UPI application from the App Store / Bank website

- Creates your profile by entering details like username, virtual ID (payment address), password etc.

- The user goes to the “Add / Link / Manage bank account” option and connects the bank and account number to the virtual ID

Generating UPI – PIN:

- The user selects the bank account from which he wants to initiate the transaction

- The user clicks on one of the options –

Change m-pin

In the case of 3 (a) –

- User receives the OTP from the issuing bank on his registered mobile number

- The user now enters the debit card number and the last 6 digits of the expiration date

- After user enter the OTP and enters his / her preferred numeric UPI PIN (the UPI PIN that he / she wants to set) and clicks submit.

- After clicking submit, the customer gets a notification (successful or rejected)

In the case of 2 (B) –

- The user enters his old UPI PIN and prefers the new UPI PIN (the UPI PIN he wants to set) and clicks submit.

- After clicking submit, the customer gets a notification (successful or unsuccessful)

Performing UPI Transaction:

PUSH – sending money using virtual address

- User logs into the UPI application

- After successful login, the user selects the option for send money / payment.

- The user enters the beneficiary / recipient virtual ID, the amount and selects the account to be debited

- The user gets a confirmation screen to review the payment details and clicks on confirm

- User now enters UPI PIN

- User gets a message of success or failure

Bridge – Request Money:

- User logs into UPI application of his bank

- After successful login, the user selects the option to collect funds (request for payment)

- The user enters the virtual IDs of the senders / payers, the amount and the account to be deposited.

- The user gets a confirmation screen to review the payment details and clicks on the confirmation

- Payer will get information on his mobile requesting money

- The payer now clicks on the notification and opens his bank UPI app where he reviews the payment request.

- The payer then decides to click accept or reject

- In case of accepting payment, the payer will enter the UPI PIN to authorize the transaction enter

- Transaction complete, payer succeeds or transaction notification declines

- The recipient / requestor receives a notification and SMS from the bank for credit to their bank account

Product

A. Financial Transactions: UPI supports the following financial transactions viz.

Payment request: A payment request is a transaction where the initiating customer is sending funds to the intended beneficiary. Payment addresses include mobile number and MMID, account number and IFSC and virtual ID.

Collect request: Collect request is a transaction in which the customer is pulling funds from the intended remitter using a virtual ID.

B. Non-Financial Transactions: UPI will support the following types of non-financial transactions on any PSP app.

- Mobile Banking Registration *

- Generate One Time Password (OTP)

- Set pin

- Check transaction status

- Raise a question

FAQs related to UPI (UPI Full Form-Unified Payments Interface)

- What is UPI?

UPI, also known as UPI Full Form Unified Payments Interface, is a real-time fund transfer process that has been created by NPCI. This system works based on IMPS interface.

Which UPI app is right to download?

There are a lot of UPI apps in Google Play Store, so the user can choose any app according to his / her mind.

Is it necessary that the user download the UPI app of his own bank?

No . Users can download any UPI app. With this, you should know that it can be of your bank or any other bank also, it will not make any difference.

What is UPI PIN?

This is a pin that is set during the registration process. It is used to authorize all UPI transactions

If a user gets debit money during a UPI transaction, then what should he do in such a situation?

At such a time, money often returns to the user’s account within 1 hour. And if it does not happen during this time then you must contact customer care.

It is very often that money is deducted from the account, but still the transaction is pending pending show? What should we do in such a situation?

Transactions are often processed in such cases. This pending status shows because there may be a server issue in the backend of the payee / beneficiary. If this issue is not resolved within 48 hours then you must contact customer care.

Is it possible that with the help of more than one UPI app on the same smartphone, what link can be made to different bank account?

of course. You can definitely link the same or other bank account number with one or more UPIs.

Which mobile platforms are useful with cones where UPI can be used?

We can use UPI on Android and iOS platforms.

What is the maximum amount you can transfer through UPI?

You can transfer money up to a maximum of Rs.1 lakh per transaction.

If I ever have to register a complaint, how can I do it?

You can make this complaint only in the UPI app, for this there is an option in the app.

If anyone ever entered wrong UPI PIN then what will be the result?

User has ever entered the wrong PIN, then that ongoing transaction will fail.

If a bank name of a user is not detected through the UPI app, then what to do?

The first step should be to see that the mobile number of the user should be linked with the same bank account. If this does not happen then the app will never recognize your bank, and the linking process will never be complete.

Can other merchants be paid by UPI?

Yes of course You can give Payments in e-commerce sites through online mode if there is UPI option available there.

How can you pay in UPI online?

First you have to go to the merchant site, after that you have to choose the UPI option, then enter the VPA and then the UPI PIN.

Can a user transfer money during bank holidays?

The answer is absolutely possible.

What is the full form of UPI?

UPI Full Form- Unified Payments Interface